All Categories

Featured

Table of Contents

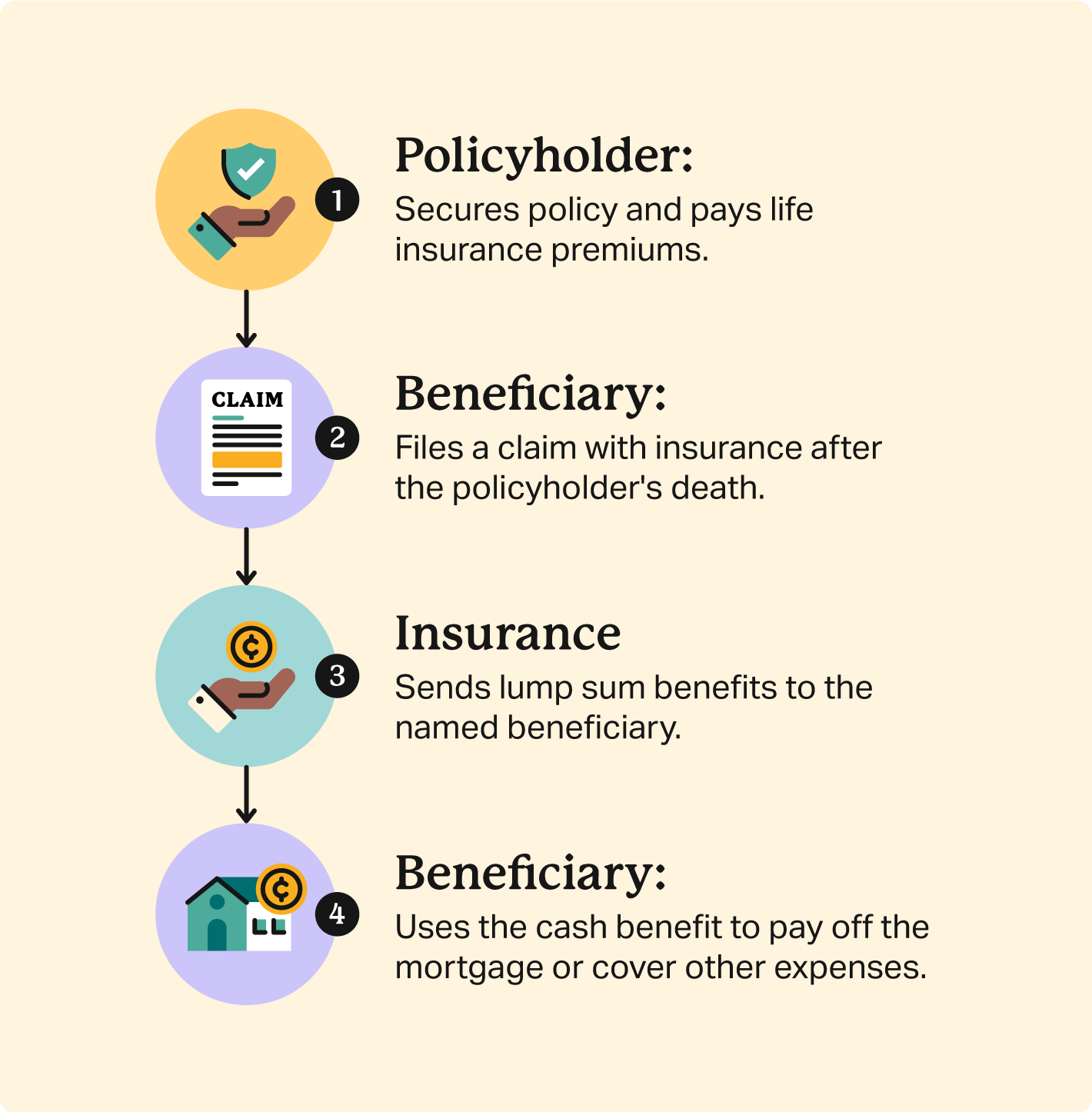

Home mortgage life insurance policy provides near-universal coverage with very little underwriting. There is frequently no clinical evaluation or blood sample needed and can be a valuable insurance plan choice for any type of property owner with severe preexisting medical problems which, would stop them from acquiring traditional life insurance policy. Various other benefits include: With a home loan life insurance policy plan in position, heirs will not have to worry or wonder what may occur to the household home.

With the home mortgage repaid, the family members will constantly have an area to live, given they can manage the building taxes and insurance every year. health insurance to cover mortgage.

There are a couple of different kinds of home loan protection insurance policy, these include:: as you pay even more off your home mortgage, the quantity that the plan covers minimizes according to the outstanding balance of your home mortgage. It is one of the most common and the most inexpensive type of home loan protection - buy ppi insurance.: the amount guaranteed and the costs you pay remains level

This will repay the home mortgage and any type of remaining balance will most likely to your estate.: if you want to, you can include significant illness cover to your mortgage protection plan. This indicates your home loan will certainly be gotten rid of not just if you pass away, but likewise if you are diagnosed with a serious health problem that is covered by your policy.

Is Mortgage Protection Insurance A Good Idea

Furthermore, if there is a balance continuing to be after the home loan is removed, this will certainly go to your estate. If you transform your mortgage, there are several things to think about, depending on whether you are topping up or prolonging your home mortgage, changing, or paying the home mortgage off early. If you are topping up your home loan, you need to ensure that your policy fulfills the brand-new worth of your home mortgage.

Compare the costs and advantages of both options (home loan cover). It may be less costly to maintain your initial mortgage protection plan and after that buy a second plan for the top-up amount. Whether you are covering up your home loan or expanding the term and require to get a brand-new plan, you might discover that your costs is more than the last time you secured cover

Mortgage Guarantee Premium

When switching your mortgage, you can appoint your mortgage protection to the brand-new lending institution. The costs and degree of cover will be the very same as prior to if the amount you obtain, and the term of your home loan does not transform. If you have a policy with your lender's group plan, your loan provider will cancel the plan when you switch your mortgage.

There will not be an emergency where a large expense is due and no chance to pay it so right after the death of an enjoyed one. You're giving satisfaction for your family! In California, mortgage protection insurance coverage covers the whole outstanding equilibrium of your financing. The death benefit is an amount equal to the balance of your home loan at the time of your death.

Do I Need Life Insurance To Get A Mortgage

It's vital to comprehend that the death benefit is given directly to your lender, not your enjoyed ones. This guarantees that the continuing to be debt is paid in full which your loved ones are saved the financial stress. Home mortgage protection insurance coverage can additionally provide momentary coverage if you become impaired for an extensive period (normally six months to a year).

There are lots of advantages to getting a home loan defense insurance coverage in The golden state. A few of the top advantages include: Assured approval: Even if you're in poor wellness or operate in an unsafe profession, there is guaranteed authorization without any medical examinations or laboratory tests. The same isn't real for life insurance policy.

Impairment security: As specified above, some MPI plans make a couple of mortgage settlements if you end up being disabled and can not generate the exact same earnings you were accustomed to. It is essential to keep in mind that MPI, PMI, and MIP are all various sorts of insurance. Mortgage defense insurance policy (MPI) is designed to pay off a home mortgage in case of your fatality.

Life Insurance With No Mortgage

You can also apply online in minutes and have your policy in location within the exact same day. To learn more concerning getting MPI protection for your home finance, call Pronto Insurance coverage today! Our experienced agents are here to respond to any questions you might have and provide additional assistance.

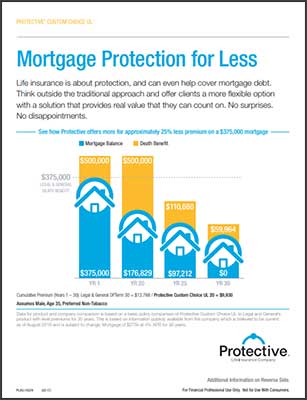

It is advisable to contrast quotes from different insurance providers to discover the most effective price and coverage for your demands. MPI uses a number of advantages, such as tranquility of mind and streamlined credentials processes. However, it has some restrictions. The fatality benefit is straight paid to the lending institution, which restricts flexibility. In addition, the advantage quantity decreases with time, and MPI can be a lot more pricey than standard term life insurance policy plans.

Is Home Insurance The Same As Mortgage Insurance

Get in basic info concerning on your own and your home mortgage, and we'll contrast rates from different insurers. We'll likewise reveal you how much protection you need to safeguard your home loan.

The main benefit right here is clearness and self-confidence in your decision, knowing you have a plan that fits your needs. As soon as you authorize the plan, we'll take care of all the documentation and configuration, ensuring a smooth execution process. The positive outcome is the comfort that includes knowing your family members is shielded and your home is protected, no matter what happens.

Professional Guidance: Advice from skilled experts in insurance and annuities. Hassle-Free Arrangement: We manage all the documentation and implementation. Affordable Solutions: Locating the ideal protection at the least expensive possible cost.: MPI especially covers your home mortgage, providing an extra layer of protection.: We work to locate one of the most cost-efficient solutions customized to your budget.

They can supply details on the coverage and benefits that you have. On average, a healthy and balanced individual can expect to pay around $50 to $100 each month for home loan life insurance policy. However, it's suggested to acquire an individualized home mortgage life insurance policy quote to obtain a precise quote based upon specific circumstances.

Latest Posts

Life Insurance Policy To Pay For Funeral

Burial Insurance For Seniors Over 60

Choice Mutual Life Insurance